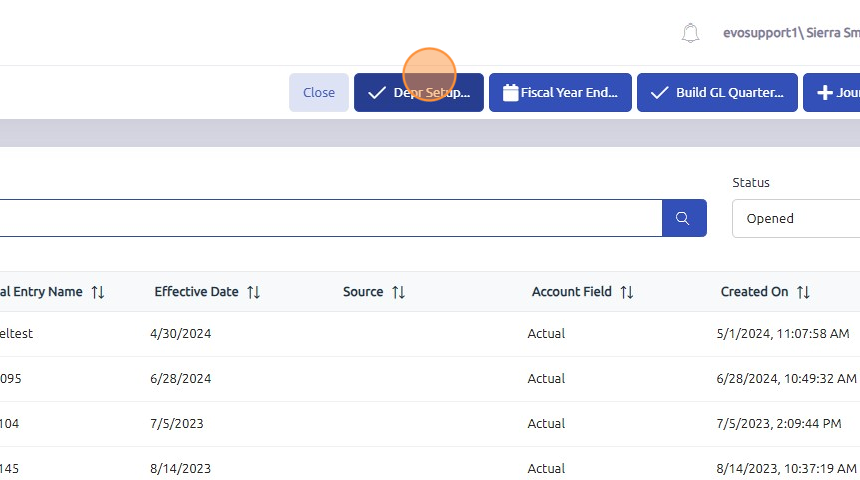

1. Depreciation Setup is located under Accounting > Journal Entry > "Depr Setup"

2.

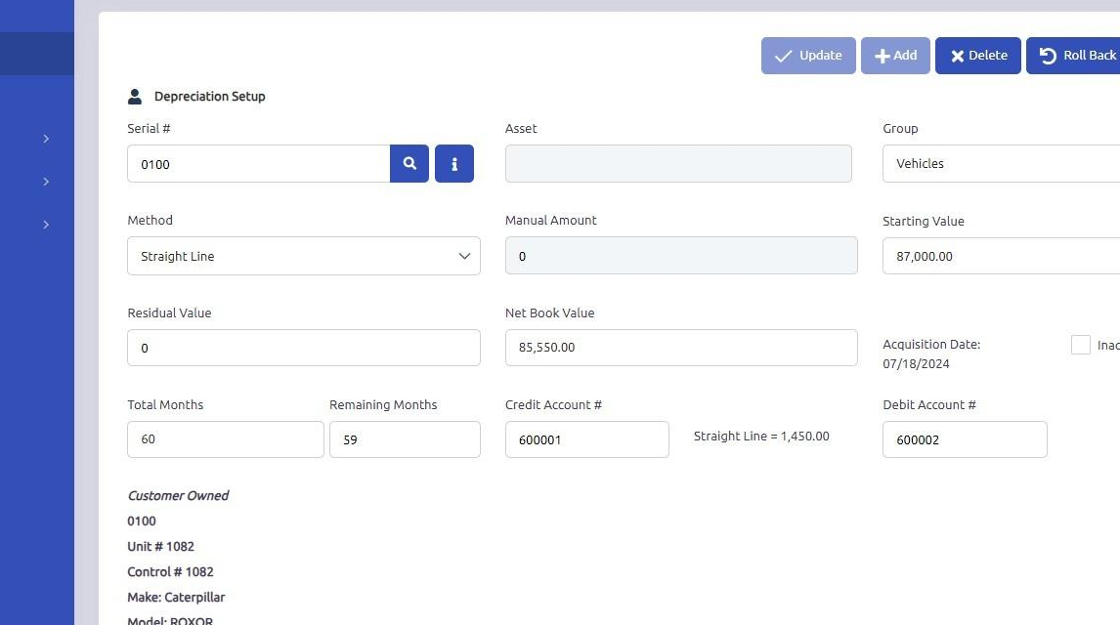

1. Enter or search for Serial # to set depreciation schedule for. The Asset field is also available to enter a value in place of Serial #.

2. Assign the Serial # to a Depreciation Group. Depreciation Journals will be created based on Group.

3. Select your Method of Depreciation. (1) Straight line to calculate a flat rate based on the Starting and Residual Values or (2) Manual to enter a Manual Amount for each depreciation entry.

4. Enter the Starting Value of the Serial #

5. Enter the Residual Value of the Serial #. Residual value is the estimated value of an asset at the end of its useful life or lease term, after depreciation costs have been deducted.

6. Enter the total number of months you plan to run depreciation for.

7. Enter the Credit and Debit accounts to be used when posting the depreciation journal.

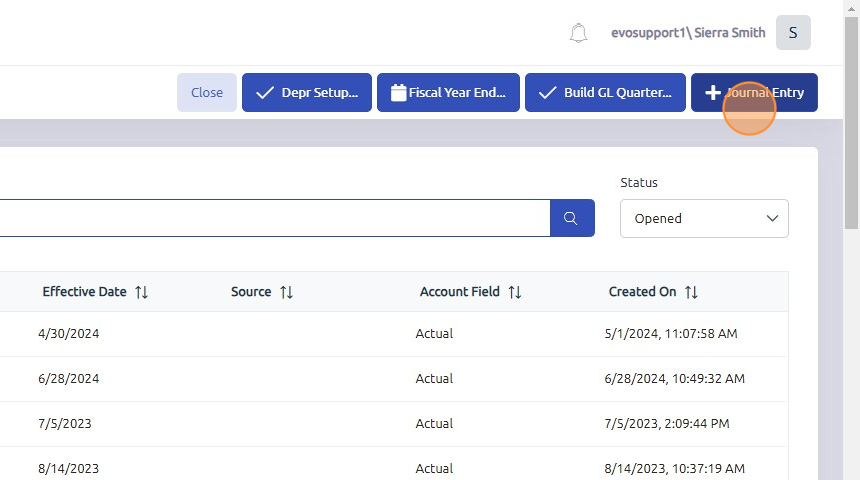

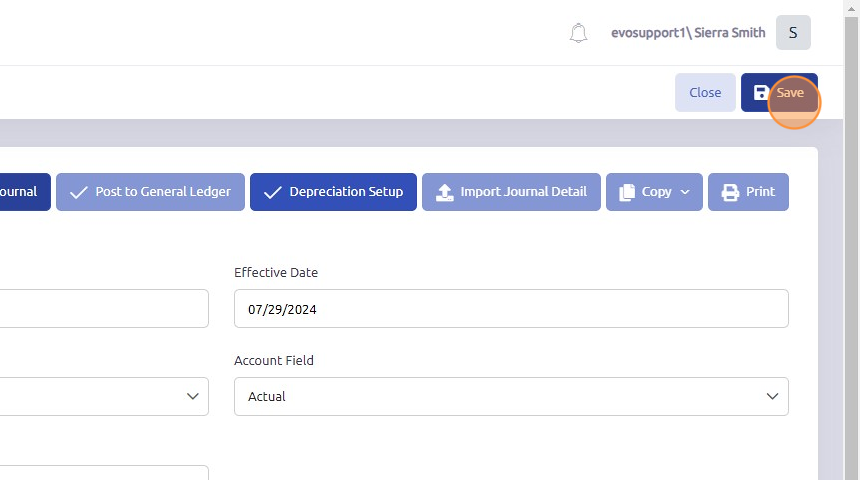

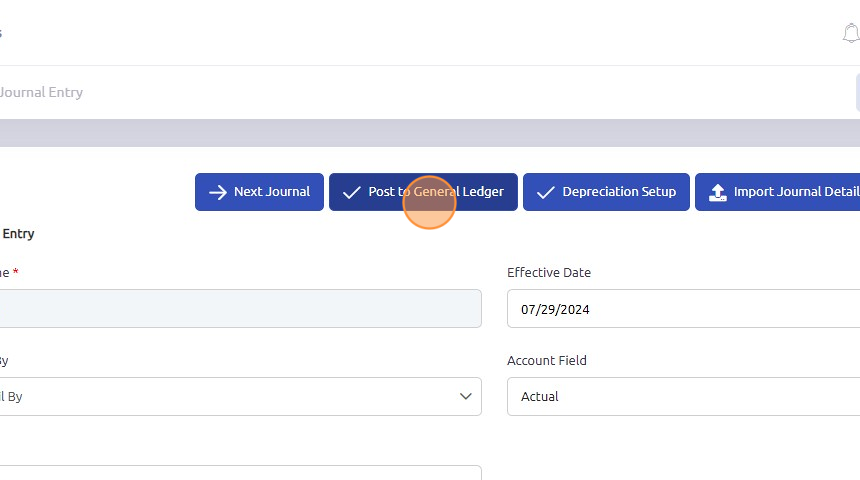

3. To post the Depreciation Journal, navigate to Accounting > Journal Entry > + Journal Entry

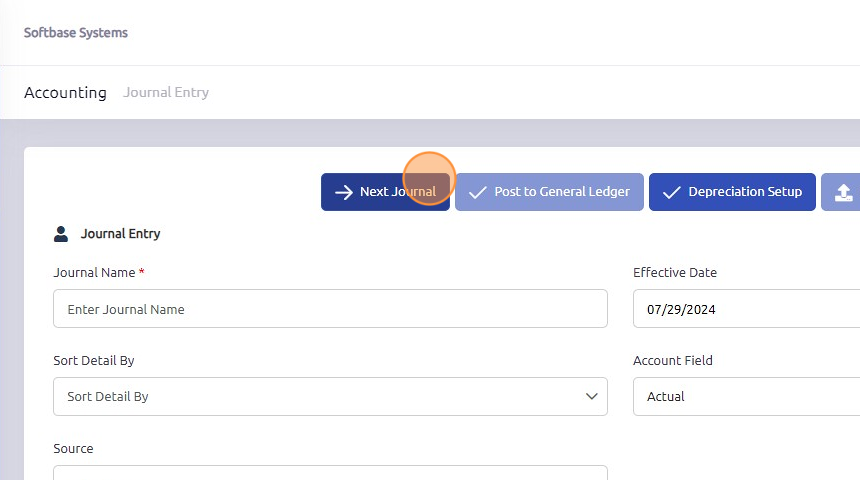

4. Click "Next Journal" to assign journal name.

5. Click "Save"

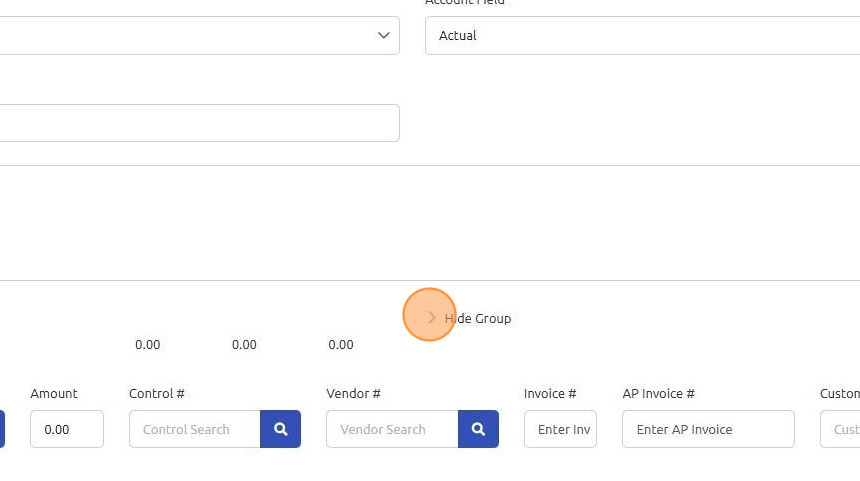

6. Click here to expand the list of depreciation groups.

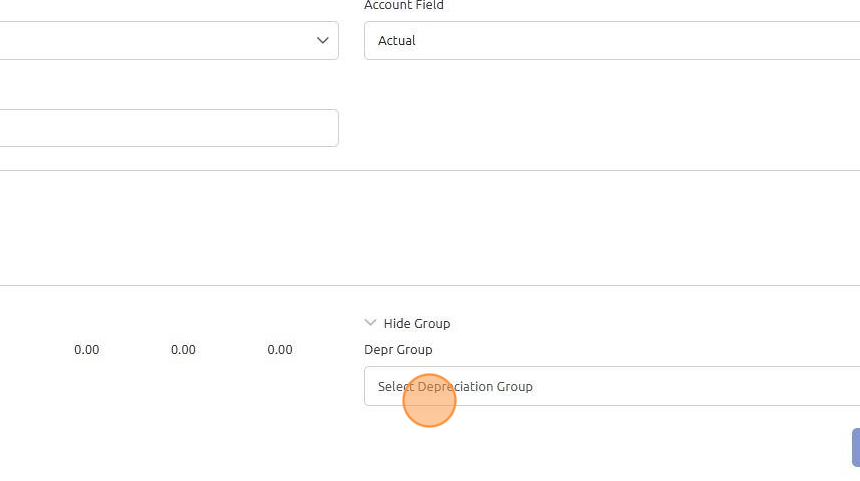

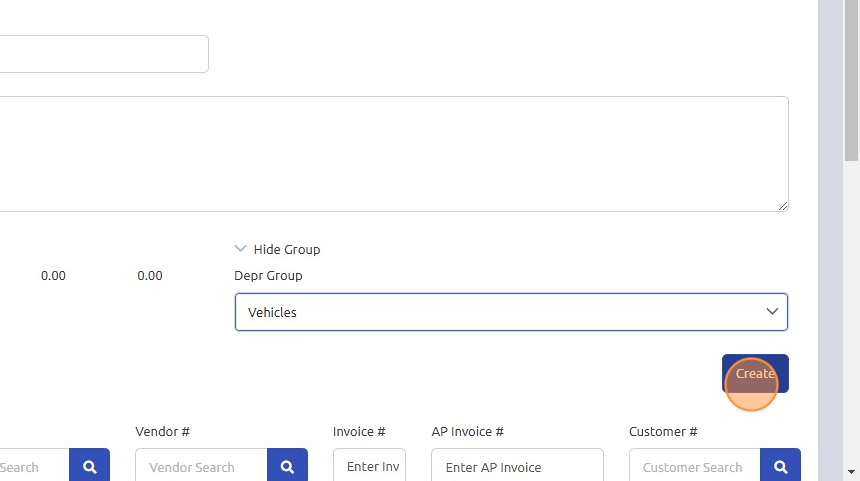

7. Select depreciation group from dropdown.

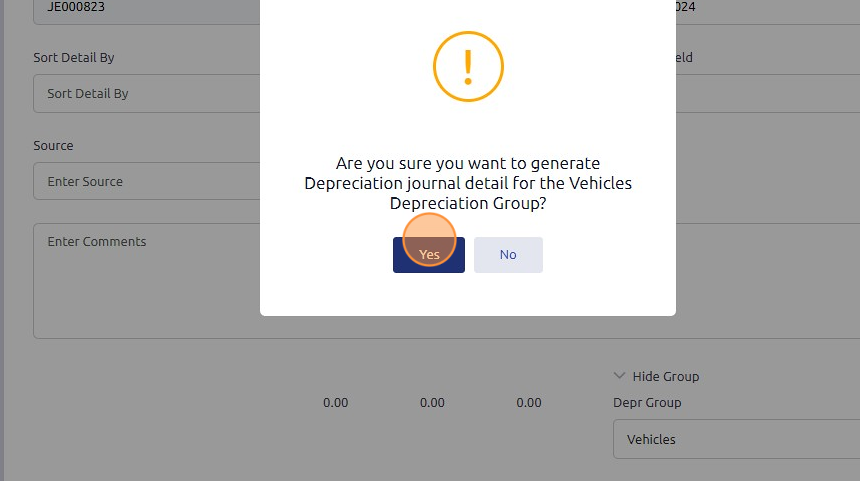

8. Click "Create" to generate the debit/credit entries for each asset in the selected depreciation group.

9. Click "Yes"

10. Click "Post to General Ledger" to post journal entry.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article