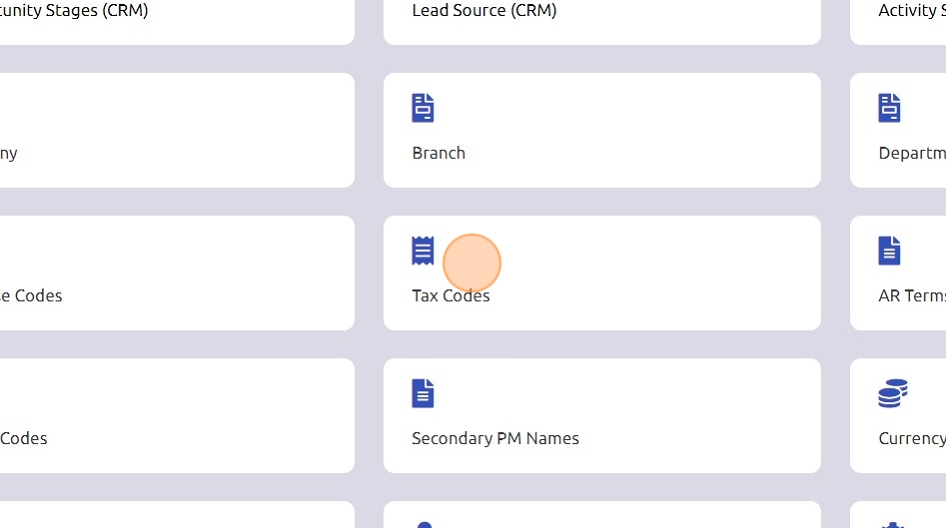

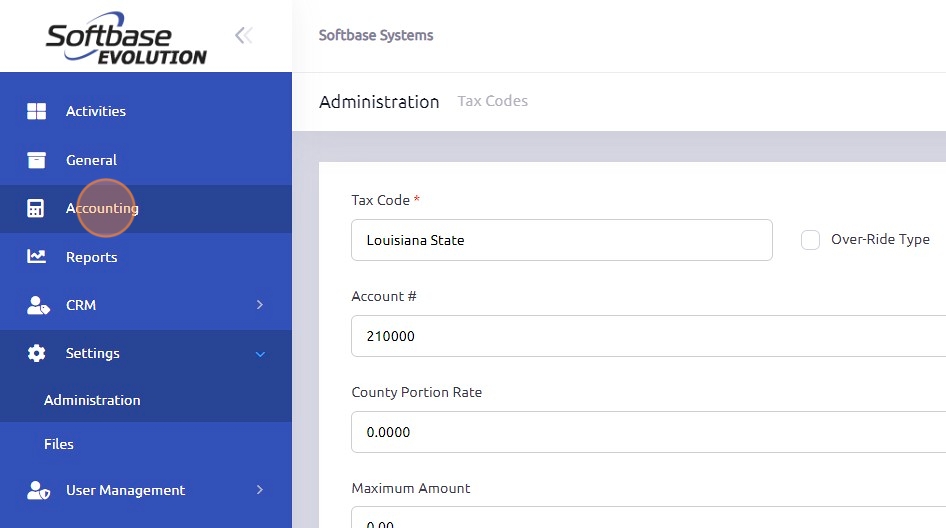

1. In the Administration Settings click on the "Tax Codes" program.

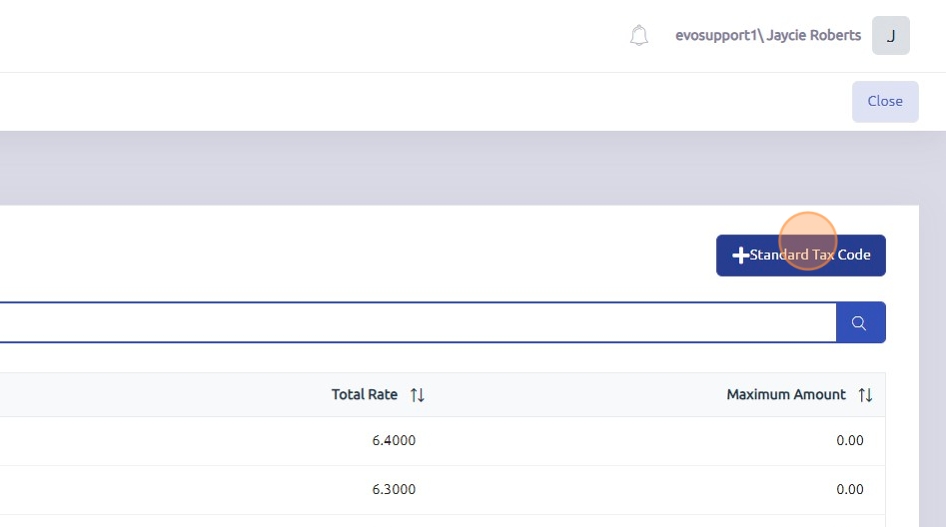

2. Click "Add Standard Tax Code"

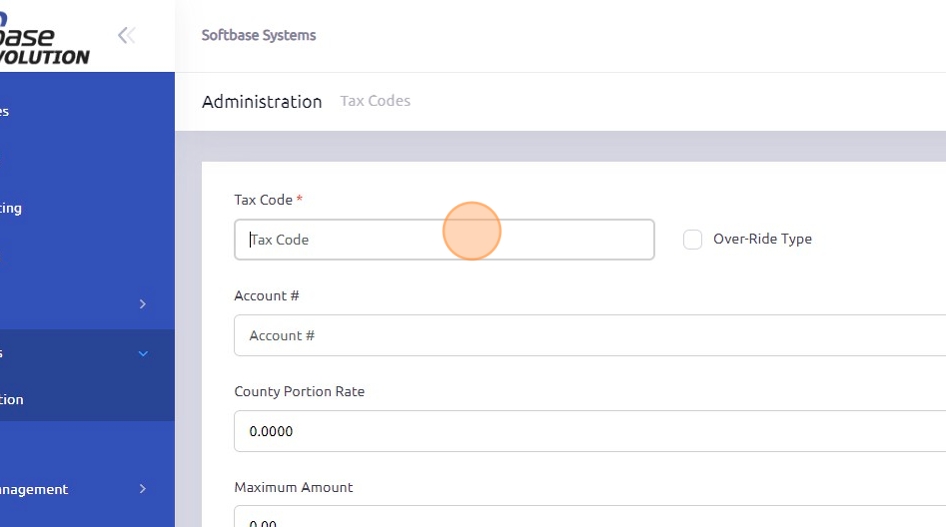

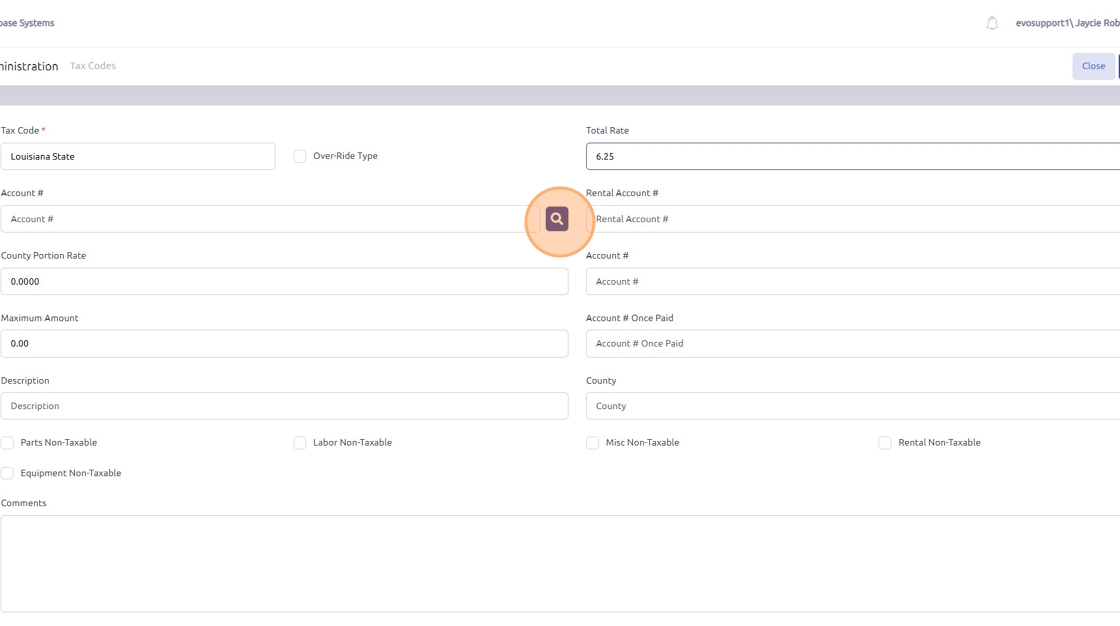

3. Click the "Tax Code" field and enter the name of the standard tax code. Example. Louisiana State Taxes.

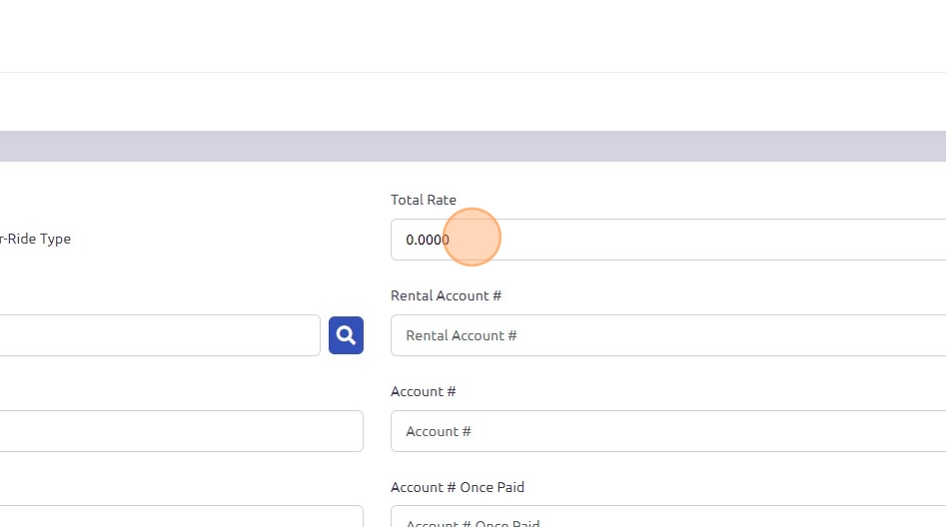

4. Click the "Total Rate" field and enter the percentage of the taxes.

5. Enter or utilize the search function for the corresponding tax account.

6. The optional check boxes below the field information are specific to the tax code itself.

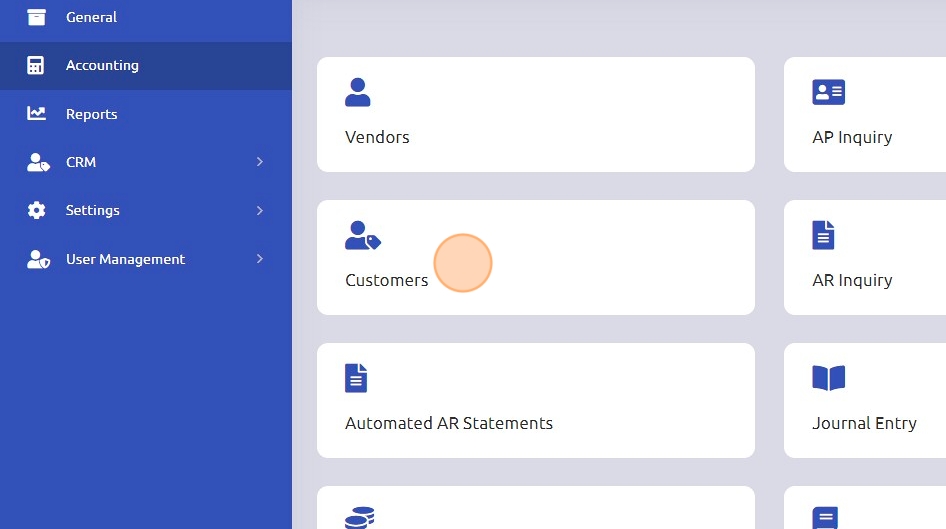

7. To add the specific tax code to a customer, click "Accounting".

8. Click "Customers"

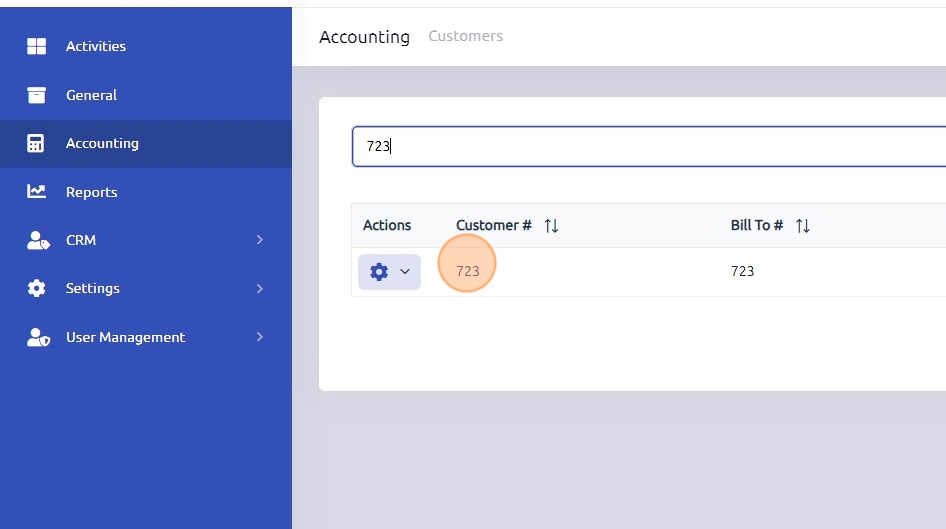

9. Enter and select the correct customer number.

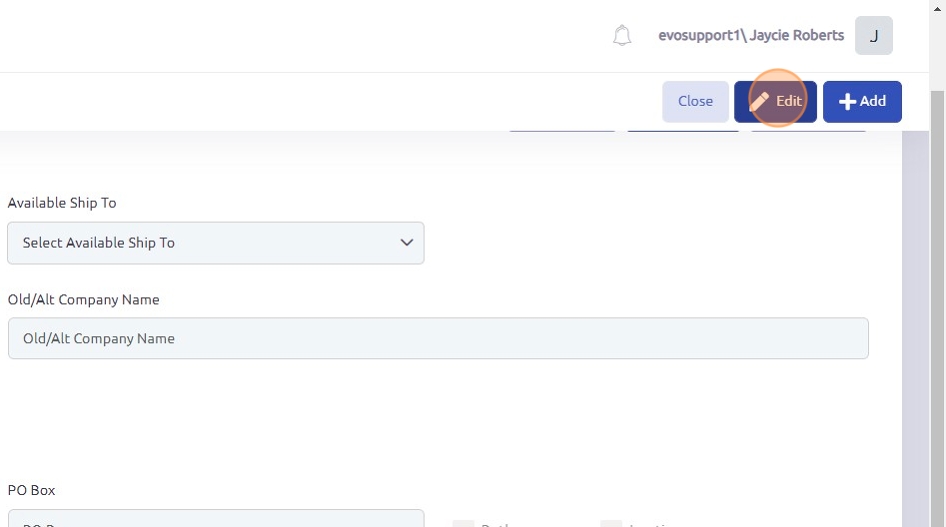

10. Click "Edit"

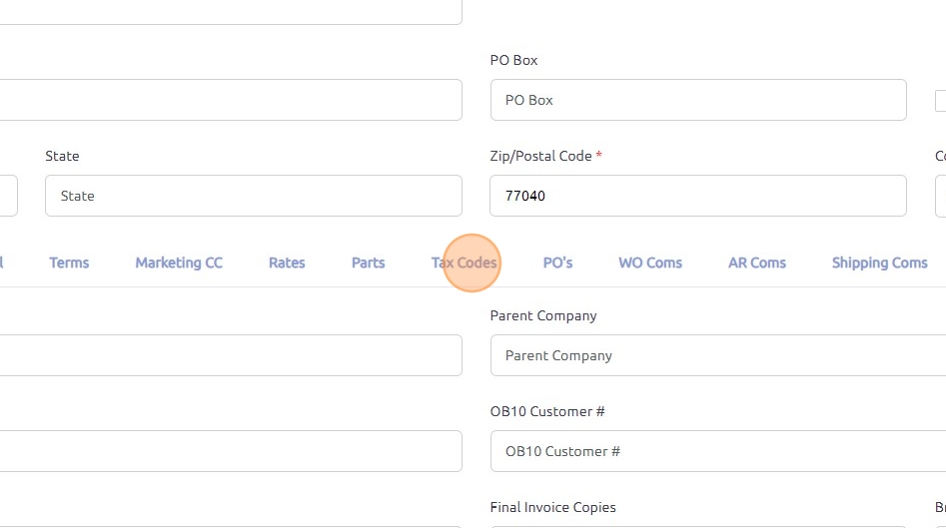

11. Click "Tax Codes"

12. In the "Override Tax Codes" dropdown, select the correct tax code for the customer. When entering a new customer, the appropriate tax code must be chosen from this dropdown to ensure the correct taxes are applied or to mark the customer as tax-exempt if applicable.

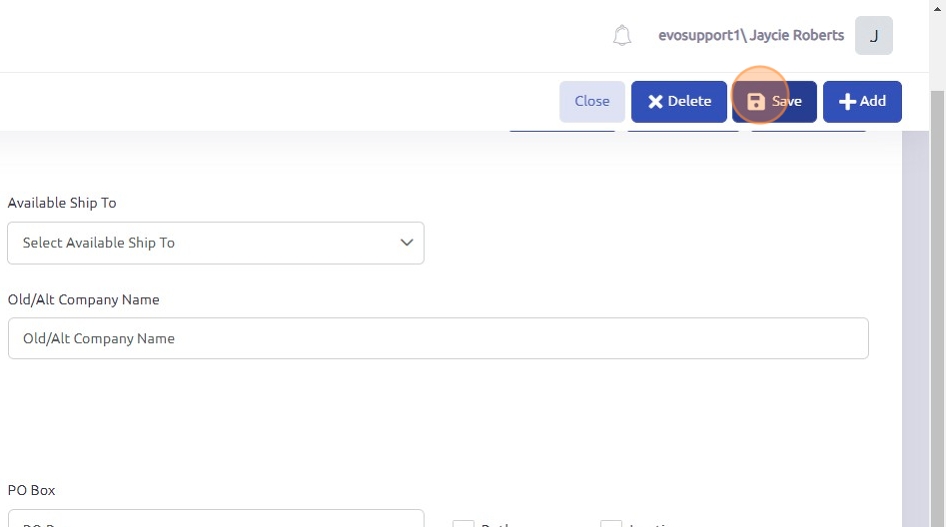

13. Click "Save".

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article